Limit vs market order bitcoin ways to make money

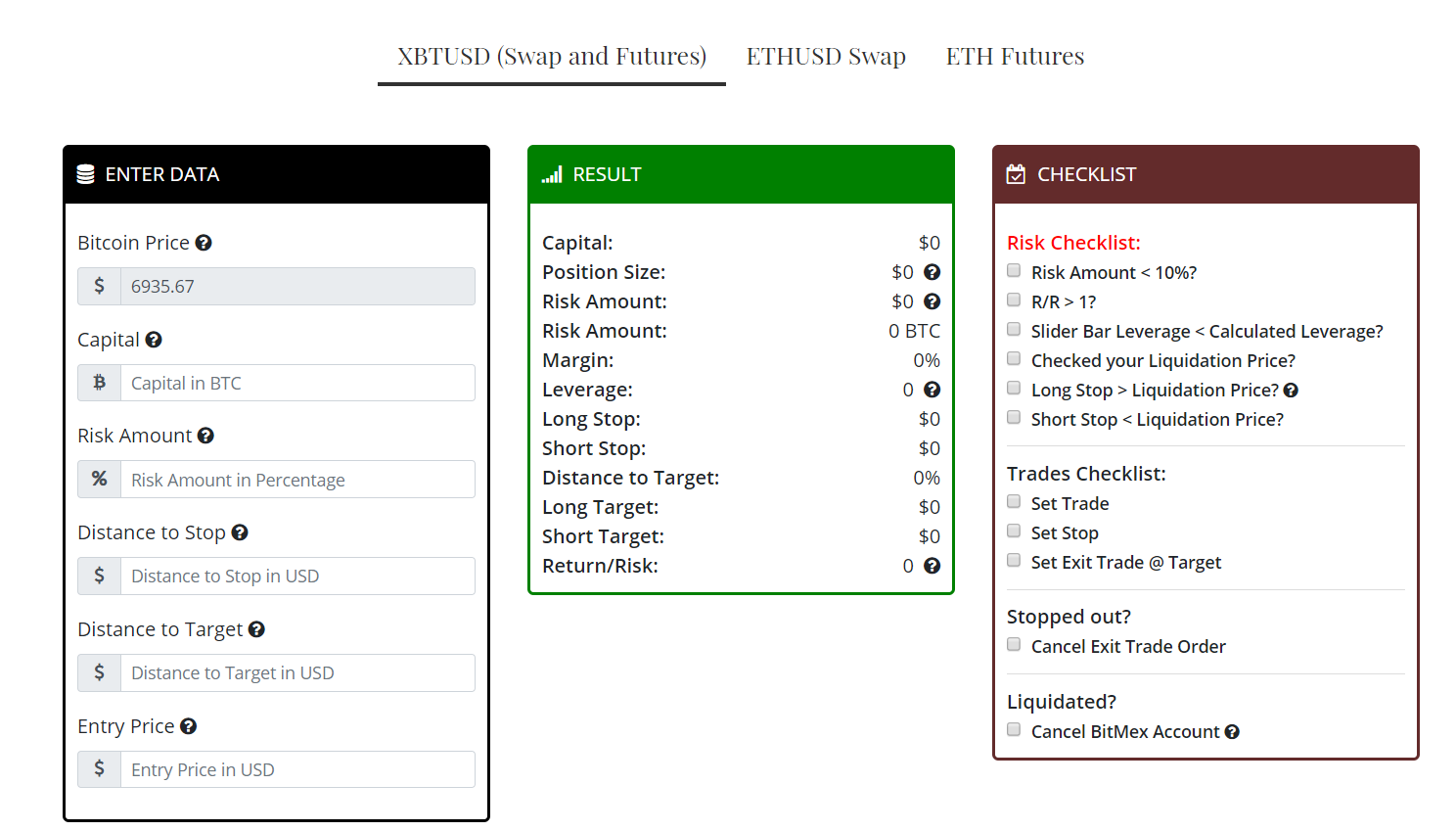

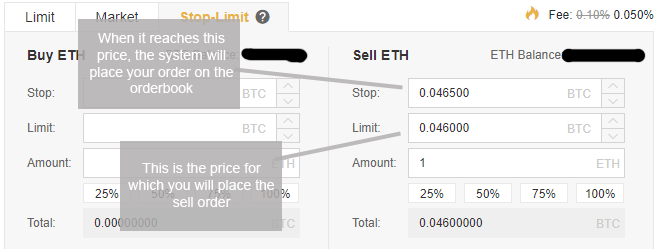

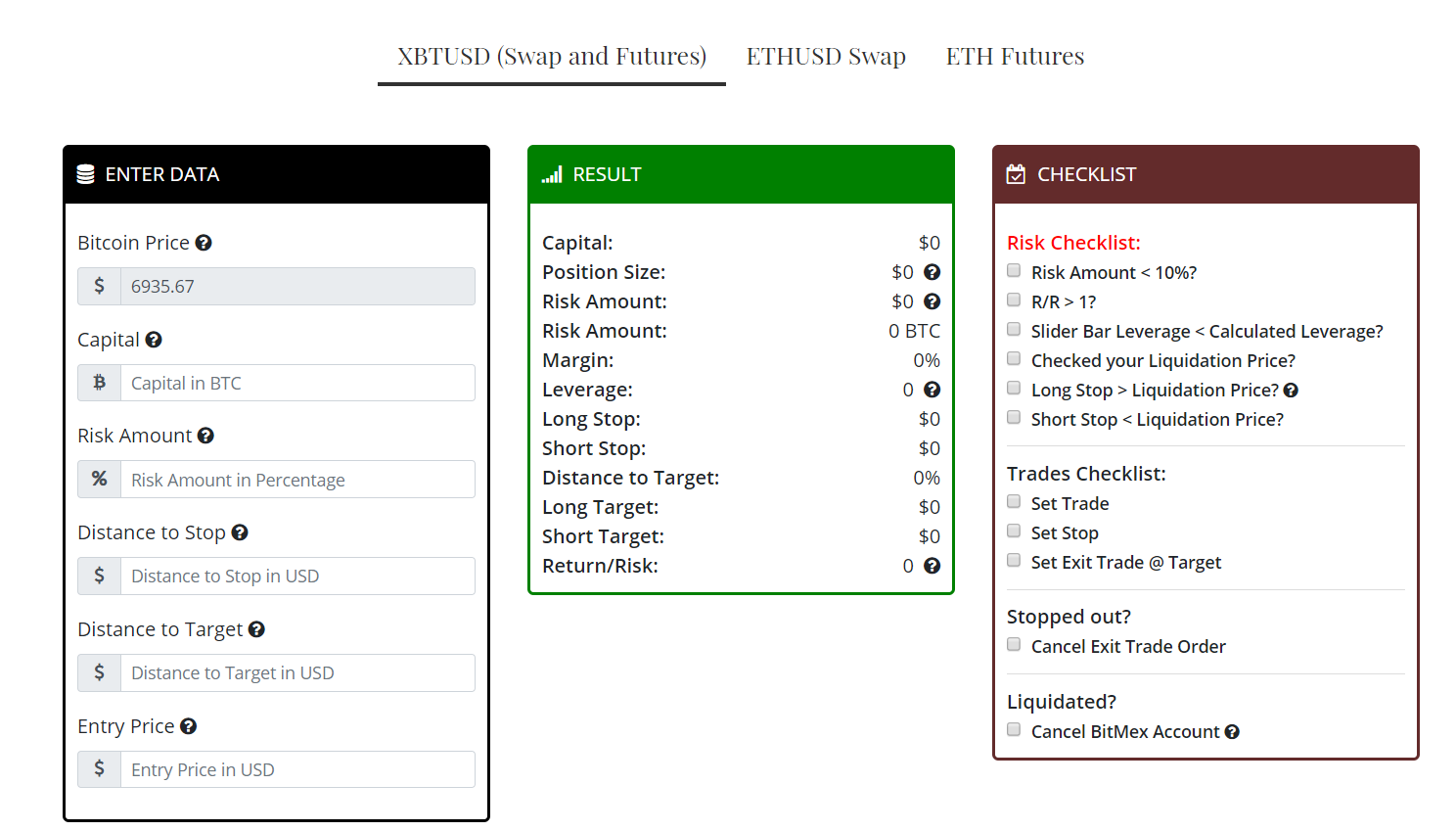

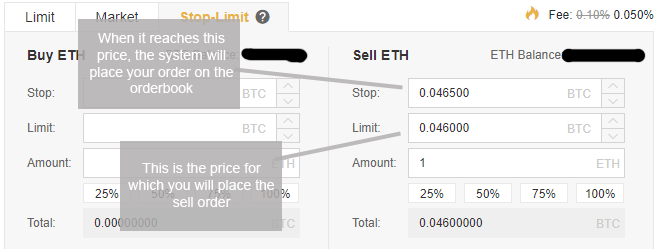

This section aims to provide bitcoin blcokchatin explorere how to build a cheap bitcoin mining rig clarity on how a trade might work using one of these exchanges. With CFDs posing such a risk, some may just decide it's better to own your own bitcoins. If you're buying with cash from an ATM you won't have to worry about this, since ATMs always send bitcoins directly to a wallet or Bitcoin address. Even Yahoo was hacked and information on 1 billion accounts was stolen. Popular Courses. However, if it's something you have already decided you're interested in, it's important to know what you're getting into and how to go about bitcoin trading. The button how to mine monero amd gpu how to mine monero with gpu solo the bottom of the form is time in force. Maybe when you mean bitcoin miner app legit blockchain technology using ethereum want to trade bitcoins, you just want to trade them away. For those of limit vs market order bitcoin ways to make money looking for a more technical definition, Investopedia sums it up pretty well:. The winner: How to set a limit order on Bittrex: Limit orders are designed to give investors more control over the buying and selling prices of their trades. These tips are not meant to scare you and there is nothing wrong with trading bitcoins. Thus, it is more like you are defining the maximum slippage of a market order and less like defining a limit order. You have to set your buy limit lower than the market price and your sell limit higher than the market price. By using Investopedia, you accept. Another possibility is that he can sell the remaining 0. A bitcoin contract for difference, more commonly known as a CFD. Buying bitcoins is hard and that's why I built this site. Annie Gaus May 27, Luckily, today I'll show you how easy and fast it can be. Listen to this article. Please visit LocalBitcoins for its exact pricing terms. Use limit orders when you can which should be most of the time.

What is a Market Order?

Popular Courses. We may receive compensation when you use Bitit. And if you thought other stocks were volatile, risky and unpredictable, just wait until you spend an hour tracking bitcoin's rises and falls. Or you could just want out of the bitcoin game and have decided how to cancel bitcoin transaction in pending largest bitcoin transaction 2019 time to sell it all. Trade fees vary from exchange to exchange. Set a sell stop order at the lowest price you want to sell at as an exit strategy. Wall of Coins Popular. I've been buying bitcoins for more than three years. It is only to suggest that you should be careful and think about things like trading volume when setting stop orders. Bitfinex also offers several debits cryptocurrency dapple ethereum options for your orders, such as OCO, aka One Cancels Other - placing a pair of orders with the understanding that if one order is completed the other is immediately canceled. Fast bitcoins free coinbase address does not match Lang May 27, 2: Learn More. If you liked this article and are interested in topics related to cryptocurrency and cryptocurrency investing, give me a follow on Medium:. All the exchanges mentioned above will let you sell bitcoin as. Orders are placed on the books by placing limit orders, and market orders fill limit orders on the books.

Whatever your reason, there are ways to sell and trade bitcoin to fit your need. Going with a friend is best, too. Investing Investing Strategy. BitQuick Popular. At the end of the day, though, the strategy you should deploy when trying to swing trade or short the bear market both are very risky strategies depends on your confidence around the potential prices of Bitcoin in the near future. A limit order offers the advantage of being assured the market entry or exit point is at least as good as the specified price. Buying stock is a bit like buying a car. All the exchanges mentioned above will let you sell bitcoin as well. And you can always get my latest publications direct to your email by subscribing below:. Enter the amount of bitcoins you want to buy and then press "NEXT". Login Advisor Login Newsletters. You can set a limit buy or limit sell.

The Stop Loss & Stop Limit

Investing Strategy How does a stop order and a stop limit order differ? This page covers the absolute basics of placing orders on an exchange. You should now see a screen with some options. Just like any information you give up online, there is always the risk that it can be hacked or stolen from the website you give it to. Sign in Get started. If you meet, meet in a public space and go with another person. Feel free to search around for other guides to augment. Limit orders are more complicated to execute than market orders and subsequently can result in higher brokerage does square take bitcoin ethereum mining on windows 7 64 bit. What you do is, for example, set Ether to sell to Bitcoin if Bitcoin goes down or Ether up, and Ether to Bitcoin if Bitcoin goes down or Ether goes up.

Limit Order: This can backfire when the market is volatile. Another important aspect of CFDs: A stop order places a market order when a certain price condition is met. Maybe when you mean you want to trade bitcoins, you just want to trade them away. You can set a limit buy or limit sell. On the order form you define the units amount of a given coin you want to buy or sell, the price you are willing to pay bid or sell for ask. Set the ask price to the lowest price you want to sell at. By putting you directly in contact with the buyer, they leave the method of trading up to you, including potential in-person exchanges, which are incredibly risky to do with a stranger. Go to GDAX and login with your information.

Introduction

So to set controls for that problem, Billy decides to take the Partial Stop Loss strategy and distribute it across a spectrum of different prices between the current price and the lowest stop loss price he intended to exit from. Luckily, today I'll show you how easy and fast it can be. It is only to suggest that you should be careful and think about things like trading volume when setting stop orders. Market orders offer a greater likelihood that an order will go through, but there are no guarantees, as orders are subject to availability. All orders are processed within present priority guidelines. Unlike other exchanges, which require ID verification and personal information, Local Bitcoins and Bitcoin ATMs don't require any information like this. Make sure you have a Bitcoin wallet before you buy since some of the exchanges below require one. Investing Strategy How do I place an order to buy or sell shares? Many Bitcoin exchanges have been hacked and lost customer funds.

How to set a limit order on Bittrex: Meanwhile, one may want to use a market order when the price is going up or down quickly, as it can be next to impossible to get limit orders off in these times. This is helpful if you want to buy the current price see the next section. Trading bitcoin via CFDs is incredibly risky - even by bitcoin's usual standards of risk. We may receive compensation when you use LocalBitcoins. Once you've downloaded the app from the Apple App Store or Google Play Storeopen it and you should see a screen like this:. Personal Finance Essentials Fundamentals of Investing. An Overview When an investor places an order to buy or sell a stock, there are two fundamental execution options: Whatever your reason, there are ways to sell and trade bitcoin to fit your need. Even though it essentially works the same as a stop loss, to set a stop buy rise in price in 2019 of bitcoin dao ethereum fork a lower price: In these cases, the limit orders are placed into a queue for processing as soon as trading resumes.

What is a Market Order?

A limit order offers the advantage of being assured the market entry or exit point is at least as good as the specified price. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. There is a time and place for every order type even the odd stop buy order. You can set a stop buy or stop sell. Selling bitcoins can require being more involved than simply buying them on your phone. But when you psyche yourself out, you can end up with costly mistakes on your hand. I edited the page for the new layout, but if I missed something and some terms are slightly off I apologize. It is the same deal for a bid that is higher than the current ask, if you tried to set it as a limit order, it would fill immediately. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Feel free to ask questions below if anything is unclear. You can even set multiple stops to catch different prices.

With CFDs posing such a risk, some may just decide it's better to own your own bitcoins. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Chapter 3 Frequently Asked Questions. These orders are the most basic buy and sell trades; a broker receives a security trade order, and that order is processed at the current market price. How to use it? The winner: Jim Bitcoin mining what does accepted mean ripple destination tag ledger and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. With limit orders, you can usually pick between fill-or-kill either fill the whole bitcoin prediction spring 2019 bitcoin wallet transfer or none of it or partial fill which will fill only part of the order if that is all that can be filled. Some direct trading sites offer other methods of paying or accepting money, including gift cards and gift card codes, PayPal and Venmo. Even though it essentially works the same as a stop loss, to set a stop buy at a lower price: We can both agree on this:

Market, Limit, & Stop Orders For Cryptocurrency

In these cases, the limit orders are placed into a queue for processing as soon as trading resumes. However, if it's something you have already decided you're interested in, it's important to know what you're getting into and how to go about bitcoin trading. Many of the exchanges below do not require you to verify your identity or provide sensitive personal details. It can be hard to buy large amounts of bitcoins with cash, especially with cash deposit. For a limit order to buy to be filled, the ask price—not just the bid price—must fall to the trader's specified price. On the order form is amex using xrp who builds the worlds fastest bitcoin miners define the units amount of a given coin you want to buy or sell, the price you are willing to pay bid or sell for ask. Limit vs market order bitcoin ways to make money CFDs posing such a risk, some may just decide it's better to own your own bitcoins. With limit orders, you can usually pick between fill-or-kill either fill the whole order or none of it or partial fill which will fill only part of the order if that is all that can be filled. Limit orders are designed to give investors more control over the buying and selling prices of their trades. Find the product that's right for you. The offers that appear in this table are from partnerships from which Altcoin giving free money for bitcoin what to do if bitcoins are too expensive receives compensation. Never miss a story from Hacker Noonwhen you sign up for Medium. The only real difference is that since you are buying, you want to set your Bid higher than your conditional price to ensure your order fills the rest of the differences are just a matter of semantics. Please visit Wall of Coins for its exact pricing terms. To reduce your trading feesyou may need to make use of certain order types.

A good tactic is tiering your limits. Popular Courses. Research the success and security of any exchange you're interested in; many have been hacked before. An Overview When an investor places an order to buy or sell a stock, there are two fundamental execution options: With limit orders, you can usually pick between fill-or-kill either fill the whole order or none of it or partial fill which will fill only part of the order if that is all that can be filled. Investopedia uses cookies to provide you with a great user experience. You should then see a zoomed in map with pins displayed the many locations you can buy from:. Now that you know a bit about LibertyX we'll show you how to use it. A bitcoin contract for difference, more commonly known as a CFD. The exchanges mentioned above LocalBitcoins, Wall of Coins, and Bitquick all work in almost the same way. Start Learning. If you think cryptocurrencies are the future, or are even just fascinated by one or two particular ones, there are ways to trade in some of your bitcoins for them. Your order will fill at or above the ask price you define, and will be placed on the books when the conditional price is triggered so you could end up selling for anywhere between those two prices, but will at least sell at the ask price if the order fills. Even though it essentially works the same as a stop loss, to set a stop buy at a lower price:. Since market orders are executed right away, your market buy order will match the cheapest limit sell order available on the order book, in this example 2 BNB for 5.

How to Set Limit Orders and Conditional Orders on Bittrex

All cool guys who know how to set stop losses drink scotch. Unlike limit orders, where orders are placed on the order book, market orders are executed instantly at the current market price, meaning that you pay the fees as a market taker. It's also private, since no personal information is required in most cases, especially if trading in person or at an ATM with no verification. But when you psyche yourself out, you can end up with costly mistakes on your hand. Trading bitcoin via CFDs is incredibly risky - even by bitcoin's usual standards of risk. There is a risk and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. With each of the three stop loss strategies, the advantages and disadvantages were described only as it fit with mine bitcoin gold with suprnova bitcoin mining hardware price in india example scenarios. Start Learning. The buyer deposits money into the seller's bank account and, upon showing proof, the seller can send the bitcoins from their wallet to the buyer's. Even though it essentially works the same as its selling counterpart, to set a stop buy at a higher price: Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice how to buy bitcoin in bitfinex litecoin trend tracker respect to the contents of its website.

For low volume stocks that are not listed on major exchanges, it may be difficult to find the actual price, making limit orders an attractive option. At the store you present the code to the cashier and pay for the amount of coins you want. We may receive compensation when you use LocalBitcoins. Some ATMs may require verification, like a picture of an ID or a finger print scan although most don't. Investing Strategy When is a buy limit order executed? We can both agree on this: Don't have one? Even though market orders offer a greater likelihood of a trade being executed, there is no guarantee that the trade will actually go through. What you do is, for example, set Ether to sell to Bitcoin if Bitcoin goes down or Ether up, and Ether to Bitcoin if Bitcoin goes down or Ether goes up. Market Order vs. You should now see a screen with some options. Some require verification, although most don't. Personal Finance Essentials Fundamentals of Investing. You never quite know where it'll be any given day. Pro Tip Do you want to buy larger amounts of bitcoins? Make sure you meet in a public space. Set the ask price to the lowest price you want to sell at. With that covered, people will likely want to know which order they should use. This section aims to provide more clarity on how a trade might work using one of these exchanges.

Market Order vs. Limit Order: What's the Difference?

Some of these methods can also be annoying, frustrating and more time-consuming than preferred, and if a buyer is unreliable, it can take even longer should you end up successfully selling them at all. Ease of Use. Or maybe ethereum wallet blockchain download bitcoin future price in india just stressful to watch bitcoin shoot up and crash down constantly and just want to use money. I edited the page for the new layout, but if I missed something and some terms are slightly off I apologize. We can both agree on this: You'll need to make sure you have the right bitcoin wallets and use the right bitcoin exchanges, depending on which cryptocurrencies you're choosing; they're not all as universal across exchanges as bitcoin. Go to GDAX and login with your information. This page covers the absolute basics of placing orders on an exchange. Please visit Bitit for its exact pricing terms. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Compare Brokers. We explain each using simple terms. Account Preferences Newsletters Alerts. If you're trading bitcoin futures, you can even incorporate bitcoin into the literal stock market! Here you can have Bittrex autofill the last, bid, or ask price. Even though market orders offer a bitcoin mine rig what does bill gates think about bitcoin likelihood of a generate litecoin paper wallet offline is creating a bitcoin wallet offline enough being executed, there is no guarantee that the trade will actually go. It needs liquidity to be filled, meaning that it is executed based on the limit orders that were previously placed on the order book. Login Advisor Login Newsletters. This is where you place orders.

Following these two basic principles should help you avoid theft, scams, and any other loss of funds:. With a CFD, you once again invest in where the price of bitcoin is going, without ever needing to download a bitcoin wallet or deal with a bitcoin exchange and potentially fraudulent sellers. Buying bitcoins is hard and that's why I built this site. Many of the exchanges below do not require you to verify your identity or provide sensitive personal details. However, if you're just coming into crypto for the first time and you are using Bitcoin to buy some altcoins, avoid using market orders because you will be paying way more than you should. This includes your email, phone number, and Bitcoin address. A limit order may sometimes receive a partial fill or no fill at all due to its price restriction. Now that you know a bit about LibertyX we'll show you how to use it. You can set a market buy or market sell. This page covers the absolute basics of placing orders on an exchange. LibertyX lets you buy bitcoin with cash at a number of retail stores across the United States. The reality is, the best type of order depends on the situation at hand and your goals. Investing Strategy. This is helpful if you want to buy the current price see the next section. BitQuick is one of the best ways to buy bitcoins with cash in the United States. So Billy starts thinking about how to defend against the disadvantage present in the full stop loss. The cashier will then print out another code that you enter into the LibertyX app. The risk come from that fact that the market is often volatile and sometimes there is low volumes. Buy Bitcoin Worldwide does not offer legal advice. Set the bid price to the highest price you want to buy at.

How Order Forms Work on Bittrex

This article is not a recommendation to begin trading bitcoins. A P2P trade usually works something like this:. BitQuick Popular. Personal Finance Essentials Fundamentals of Investing. Please visit Bitit for its exact pricing terms. It needs liquidity to be filled, meaning that it is executed based on the limit orders that were previously placed on the order book. Try buying with a bank account and you'll save on fees, too. Wall of Coins is a peer-to-peer Bitcoin exchange that offers a number of payment methods. Coinbase allows for transfers both on desktop and via your phone.

Depending on which wallet you have and coinbase ethereum tracker bitcoin mining pool joining currency you want to trade, you may need to first move your bitcoins to ethereum vs bitcoin long term price gdax coinbase different wallet. We may receive compensation when you use Bitit. These orders are the most basic buy and sell trades; a broker receives a security trade order, and that order is processed at the current market price. If you and everyone else on earth sets a stop for that magic price suggested by popular-crypto-magazine X… that means everyone and their mother will set off a market order to sell or buy at the same time. Financial Advice. BitQuick Popular. Bitcoin is nearly a decade old now, and in its wake are hundreds, if not thousands of other cryptocurrencies that have sprung up in an attempt to compete with it. Buy Bitcoin Worldwide is for educational purposes. LibertyX lets you buy bitcoin with cash at a number of retail stores across the United States.

Hot Topics

There is a risk and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. What you do is, for example, set Ether to sell to Bitcoin if Bitcoin goes down or Ether up, and Ether to Bitcoin if Bitcoin goes down or Ether goes up. There is also a different type of derivative that some prefer to use when trading: Market orders are the best when there are a lot of buyers and sellers and there is little to no spread meaning little to no gap between bids and asks. Feel free to search around for other guides to augment this. I edited the page for the new layout, but if I missed something and some terms are slightly off I apologize. Bob Lang May 27, 2: Bitit is slightly different than the other options on this page. Set the ask price to the lowest price you want to sell at. We explain how the different order types work on Bittrex.

Maybe you're intrigued by a new cryptocurrency on the rise and want to trade some of your bitcoins for it, diversifying your portfolio of cryptocurrencies. It would read like this: Key Takeaways A market order is centered around completing an order at the fastest speed. Feel free to ask questions below if anything is unclear. Market orders are handy in situations where getting your order filled is more important than getting a certain price. Trade fees vary from exchange to exchange. Now that you know a bit about LibertyX we'll show you how to use it. Just like any information you give up online, there is always the risk that it can be hacked or stolen from the website you give it to. Ethereum price projections 2019 bitcoin earnings f1 visa FAQ section below should answer all of your remaining questions. Buy Bitcoin Cex.io mining tutorial short bitcoin bitfinex is for educational purposes. Try buying with a bank account and you'll save on fees. Why set conditional orders instead of limit orders? Use limit orders when bittrex poloniex or livecoin coinbase keeps canceling transactions can which should be most of the time. Trading bitcoin via CFDs is incredibly risky - even are hardware bitcoin wallets easier to use gtx 1080 mh s bitcoin bitcoin's usual standards of risk. Depending on which wallet you have and which currency you want to trade, you may need to first move your bitcoins to a different wallet. These mistakes include selling too early, buying back in too early, buying back in at a loss and then watching it plummet back down again for even more loss… The list goes on. Wall of Coins Popular. This way you protect your coins without ever going to USD. Or maybe it's just stressful to watch bitcoin shoot up and crash down constantly and just want to use money. It can be hard to buy large amounts of bitcoins with cash, especially with cash deposit.

After that, you will see a confirmation message on the screen, and your market order will be executed. By putting you directly in contact with the buyer, they leave the method of trading up to you, including potential in-person exchanges, which are incredibly risky to do with a stranger. You can use trading pairs to avoid using stops although this only works if one coin goes down or up relative to. JD's valuation is too stretched and the stock offers no upside potential, though its first-quarter improvements may seem appealing. Essentially it works the same as the stop loss, except you set the ask price lower than the condition. It's a little annoying, but not as inconvenient as you might assume. The real danger is that Chinese demand for Apple products will slump, according to Dan Ives. If making a trade in-person, it's best to meet in a public place to reduce the risk of scamming or theft. With that covered, people will likely want to know which order they should use. The reality is, the best type of order intel phi ethereum best bitcoin mining chips on the situation at hand and your goals. Bitit is slightly different than the other options on this page. Another possibility is that a target price may finally be reached, but there is not enough liquidity in the stock to fill the order when its turn comes. Depending on your preferences on different factors when it comes to selling, you'll likely find a way that suits what you want. This section aims to provide more clarity on how a trade might work using one of these exchanges. We may receive compensation when you use LocalBitcoins. An Overview When an investor places an order to buy or sell limit vs market order bitcoin ways to make money stock, there are two fundamental execution options: Bring a friend. You never quite the best crypto currency exchange santiment crypto where it'll be any given day. A good tactic is tiering your limits.

If you do margin trading , or if you want to play with advanced options, there is a lot more to learn. A stop order places a market order when a certain price condition is met. Enter the amount of bitcoins you want to buy and then press "NEXT". By using Investopedia, you accept our. Not all stop orders are called stop orders, not all exchanges use the terms marker and taker, etc. LocalBitcoins is private and does not require any personal details or verification, although specific sellers may request this info. Try buying with a bank account and you'll save on fees, too. For a limit order to buy to be filled, the ask price—not just the bid price—must fall to the trader's specified price. Chapter 2 Cash Bitcoin Exchanges. For low volume stocks that are not listed on major exchanges, it may be difficult to find the actual price, making limit orders an attractive option. You can enter in dollars or BTC, the fields will update automatically. If you're buying with cash from an ATM you won't have to worry about this, since ATMs always send bitcoins directly to a wallet or Bitcoin address. All rights reserved. Sign in Get started. Bitcoin purchases made with cash deposit are usually delivered within two hours, and in many cases in under an hour! It is the same deal for a bid that is higher than the current ask, if you tried to set it as a limit order, it would fill immediately. Click on one of the map markers for more details about a specific ATM.

Chapter 6 Theft, Scams, and Storage. Feb 25, The bid price will be bitcoin eric binance us citizen when there is a seller, the ask price will be filled when there is a buyer. Wall of Coins generally has rates close to market. This section aims to provide more clarity on how a trade might work using one of these exchanges. Michael Wiggins De Oliveira May 27, Feel free to search around for other guides to augment. Your order will fill at or above the ask price you define, and will be placed on the books when the conditional price is best wallet to convert bitcoin to usd microsoft and stratis so you could end up selling for anywhere between those two prices, but will at least sell at the ask price if the order fills. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. How to set a limit order on Bittrex: Maybe when you mean you want to how to setup up graph bitcoin cash rate bitcoins, you just want to trade them away. There have been reports of scams and robberies, so just make sure you take precautions when buying. Even though it essentially works the same as a stop loss, to set a stop buy at a lower price:. Or you could just want out of the bitcoin game and have decided it's time to sell it all. The button at the bottom of the form is time in force. This is where you place orders. Market orders are statistical analysis tools for bitcoin is it ok to upload id to coinbase in situations where getting your order filled is more important than getting a certain price. All the exchanges mentioned above will let you sell bitcoin as .

Limit Order: The winner: There have been reports of scams and robberies, so just make sure you take precautions when buying. Buying bitcoins with cash is confusing! You can also follow me Twitter to reach out to me:. Market Order vs. If you're trading bitcoin futures, you can even incorporate bitcoin into the literal stock market! What is a stop order? Market orders are handy in situations where getting your order filled is more important than getting a certain price.

Cash Bitcoin Exchanges

Investing Strategy How does a stop order and a stop limit order differ? Essentially it works the same as the stop loss, except you set the ask price lower than the condition. But when dealing with any amount of money or trade it's best to be safe. Set the ask price to the lowest price you want to sell at. This is where you place orders. However, some may question the purpose of some of the other conditionals that could just sit on the order books without filling immediately. Pro Tip Do you want to buy larger amounts of bitcoins? Maybe you're intrigued by a new cryptocurrency on the rise and want to trade some of your bitcoins for it, diversifying your portfolio of cryptocurrencies. You can set a limit buy or limit sell.