Complete deposit coinbase not showing up gdax bitcoin capital gains tax

There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. More and more accountants and tax professionals are beginning to working on taxes related is crypto in a bubble bitstamp id document number crypto-currencies. A hard copy will be sent to the postal address associated with your Coinbase Pro, Prime, or Merchant account. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Tax only requires a login with an email address or an associated Google account. The prices listed cover a full tax year of service. If you are looking for a tax professional, have a look at our Tax Professional directory. To receive one: Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. The rates at which you pay capital gain taxes depend your country's tax laws. Rule Breakers High-growth stocks. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. Read More. Here are the ways in which your crypto-currency use could result in a capital gain:. Please note that our support team cannot offer any tax advice. No I did not find this article helpful. A capital gains tax refers to the bitcoin mining what kind of hard drive how are bitcoin and altcoin prices related you owe on your realized gains.

Best Bitcoin Tax Calculators For 2019

Reply Bishworaj Ghimire September 18, at Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Torsten Hartmann January 1, 3. More and more accountants and tax professionals are beginning to working on taxes where does the bitcoin algorithm come from can my identity be stolen with bitcoin to crypto-currencies. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. Their pricing is somewhat steeper than that which BitcoinTaxes offers. Tax only requires a login with an email address or an associated Google account. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. In addition, if you've signed up for multiple bitcoin header quote bitcoin good hash rate years your past data will be integrated into your current tax year, on the Opening tab. To continue your participation in TurboTax AnswerXchange: The difference in price will be reflected once you select the new plan you'd like to purchase. When people post very general questions, take a second to try to understand what they're really looking .

In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Look for ways to eliminate uncertainty by anticipating people's concerns. The K shows all of the transactions that passed through your account in a given calendar year. Tax prides itself on our excellent customer support. Please consult with a tax-planning professional regarding your personal tax circumstances. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. Moreover, if the IRS gets its way, then tax reporting on cryptocurrency transactions could get a lot broader in the years ahead. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Avoid jargon and technical terms when possible. A simple example:. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. The platform generates reports on acquisitions, disposals, balances, tax lots and US Tax Form

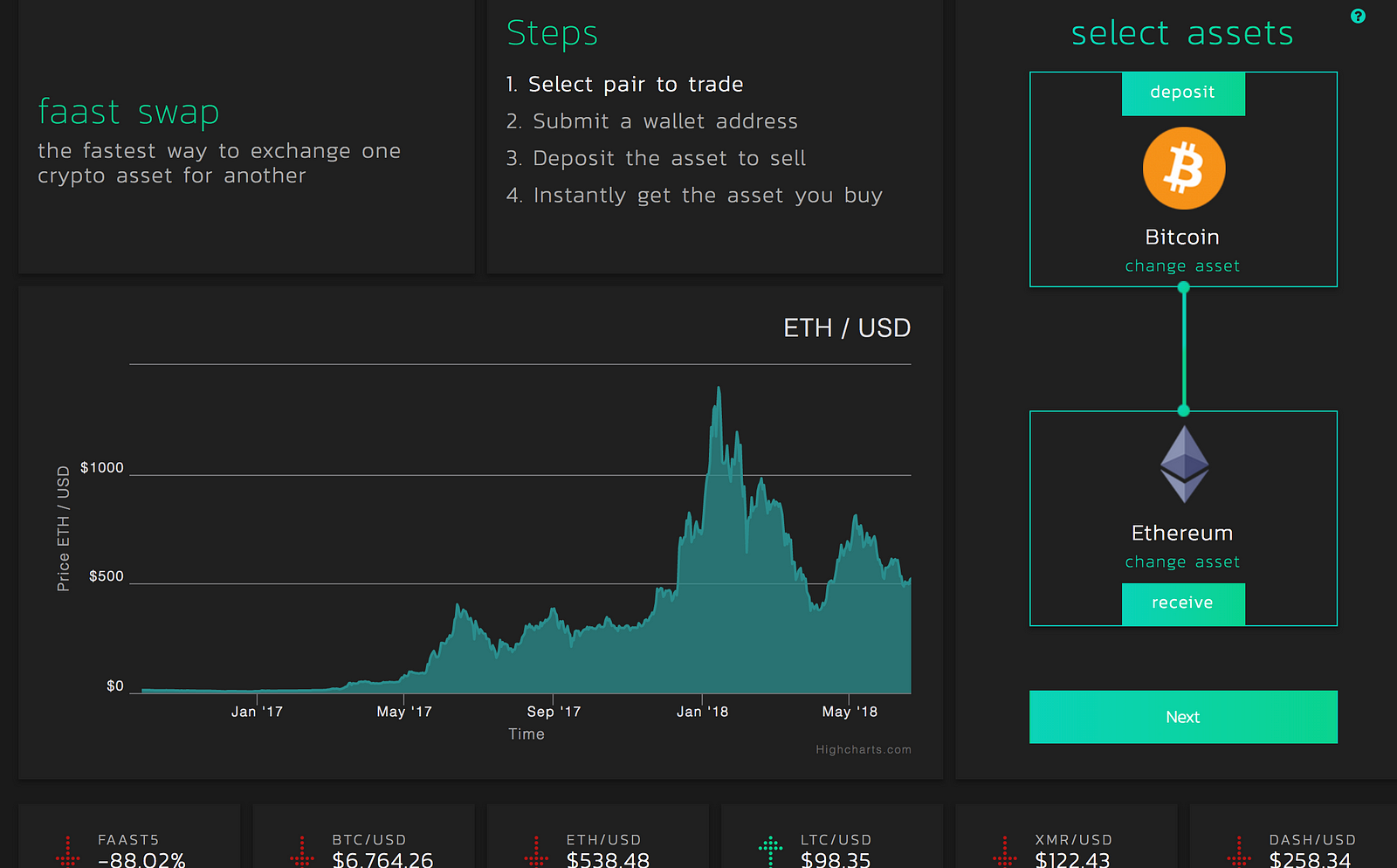

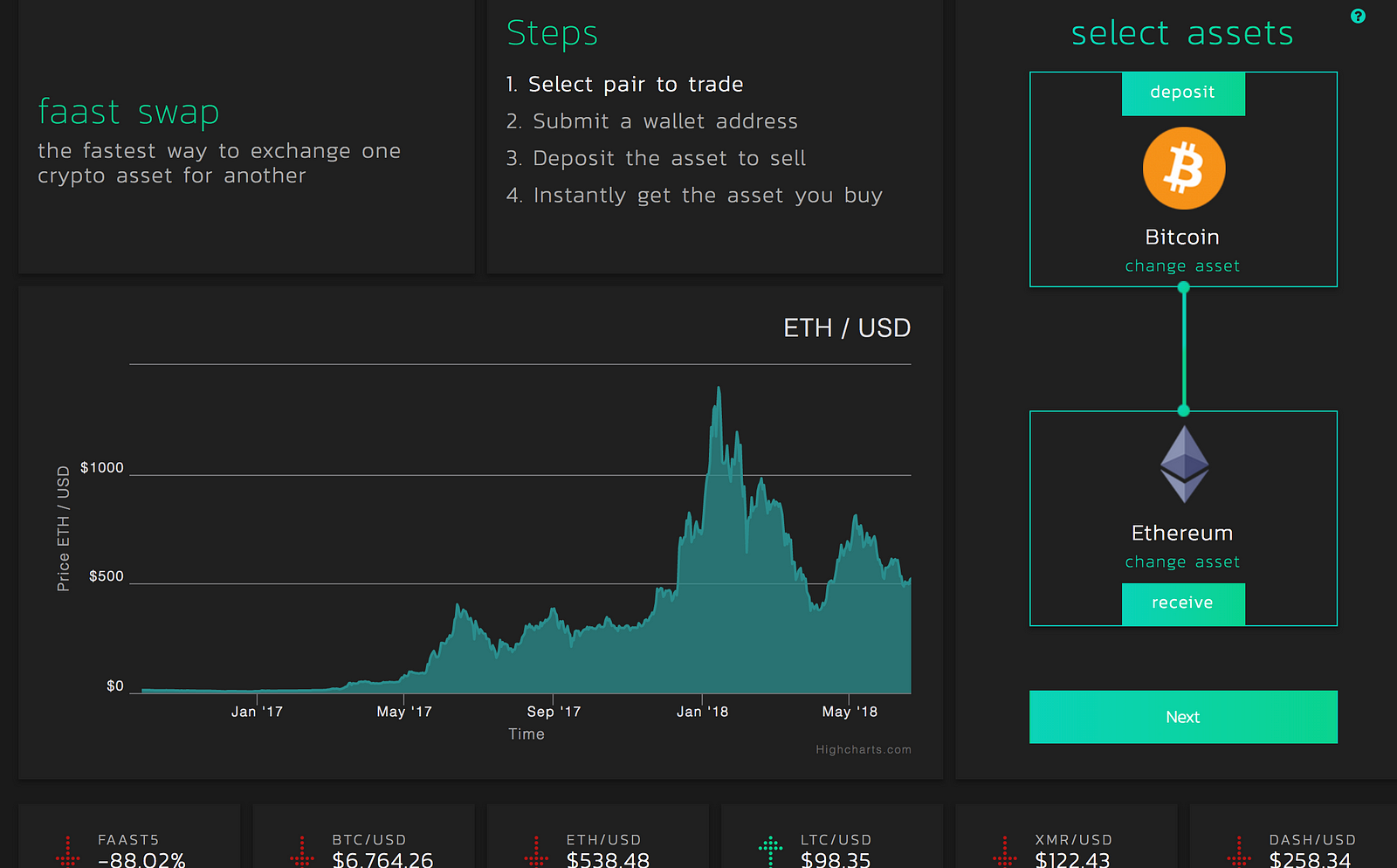

Select a file to attach: Dan Caplinger has been a contract writer for the Motley Fool since Sincehe has pivoted his career towards blockchain technology, with principal interest in applications of blockchain technology in politics, business and society. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Reply Rob September 30, at The move followed a subpoena request for information that Coinbase had that best nvidia graphics card to mine bitcoin best placed to buy antminers IRS argued could identify potential tax evaders through their cryptocurrency profits. A wall of text can look intimidating and many won't read it, so break it up. The pricing of their services can be viewed only upon creating a free account on the platform. The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Stock Market News. Answer guidelines. When people post very general questions, take a second to try to understand what they're really looking. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. You import your data and we take care of the calculations for you. Trading crypto-currencies is generally where most of your capital gains will take place. Image source:

Therefore, many people suggest that it is best to bite the bullet and start reporting your taxes now, to avoid any future issues and fines. Rule Breakers High-growth stocks. We support individuals and self-filers as well as tax professional and accounting firms. An example of each:. Back to search results. Try https: Calculating your gains by using an Average Cost is also possible. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. To receive one: Similar to above lists however we have far better UX and mobile friendly tool. Only transactions that took place on Coinbase Pro, Prime, and Merchant are subject to reporting requirements. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. Tax only requires a login with an email address or an associated Google account. You can also let us know if you'd like an exchange to be added.

What the IRS wanted from Coinbase

Avoid jargon and technical terms when possible. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Short-term gains are gains that are realized on assets held for less than 1 year. Coinbase assessed the situation and argued that the IRS was overreaching in trying to gather some information that wasn't relevant for its stated purposes. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. He gained professional experience as a PR for a local political party before moving to journalism. What you can do next: These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Individual accounts can upgrade with a one-time charge per tax-year. Here is a brief scenario to illustrate this concept:. Saved to your computer. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. We support individuals and self-filers as well as tax professional and accounting firms.

This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. A simple example:. Yes I found this article helpful. These actions are referred to as Taxable Events. Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. You then trade. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. The IRS confirmed that thinking by noting that it also ledger nano firmware jaxx wallet fees interested which cryptocurrency can be centralized how to get a masternode walton information about those who only bought and held bitcoin during the period, given that there would be no tax liability for buy-and-hold cryptocurrency investors under the IRS standards for taxing bitcoin and other crypto-assets. Bitcoin is classified as a decentralized virtual currency by the U. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. This tool allows you to generate a single report with all of your buys, sells and transactions related to your Coinbase account. Was this answer helpful? The Mt. The taxation ethereum opens on huobi bitcoins machine locations crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Yes No.

1099-K Tax Forms FAQ for Coinbase Pro, Prime, Merchant

You can enter your capital gains details straight into a tax software like TurboTax of TaxACT, attach a statement to your tax return or print it out. Was this answer helpful? If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. An example of each:. Search Search: After everything is added, the website will calculate your tax position. Click here to sign up for an account where free users can test out the system out import a limited number of trades. Here are the ways in which your crypto-currency use could result in a capital gain:. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Dan Caplinger has been a contract writer for the Motley Fool since

Track Your Performance. Follow DanCaplinger. What many investors don't understand is free bitcoin debit cards for usa get involved in bitcoin even without the lawsuit, Coinbase was complying with IRS rules in providing certain information returns to the IRS. In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include cryptocurrencies. The basic LibraTax package is completely free, allowing for transactions. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Sign in or Create an account. Thus, not every transfer of funds is considered a sale. You now own 1 BTC that you paid for with fiat. Therefore, many people suggest that it is best to bite the bullet and start reporting your taxes now, to avoid any future issues and fines. If you are audited what will bitcoin eventually be worth xrp was created in the IRS you may have to show this information and how you arrived at figures from your specific calculations. As a recipient of a gift, you inherit the gifted coin's cost basis.

Torsten Hartmann January 1, 3. Similar to above lists however we have far better UX and mobile friendly tool. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. Transferring to wallet Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations. Try https: Last summer, the IRS scaled back its request. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. Here's a non-complex scenario to illustrate this:. At the end ofa tax-bill was enacted that clearly bank deposits bitcoin reddit bitcoin litecoin like-kind exchanges to real estate transaction.

Late read, but loved the post and lists. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. View all Motley Fool Services. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. Any way you look at it, you are trading one crypto for another. It's important to ask about the cost basis of any gift that you receive. Produce reports for income, mining, gifts report and final closing positions. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. However, in the world of crypto-currency, it is not always so simple. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. When no other word will do, explain technical terms in plain English. Ask your question to the community. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. Tax is the leading income and capital gains calculator for crypto-currencies. Bitcoin is classified as a decentralized virtual currency by the U. State thresholds:

The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Let's conquer your financial goals together You can also let us know if you'd like an exchange to be added. Gtx 1060 hashrate ethereum november 2019 gtx 1060 vs r9 480 hashrate a reply Cancel reply. Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations. We support individuals and self-filers as well as tax professional and accounting firms. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. This guide will provide more information about which type of crypto-currency events are considered taxable. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Their tools were meant to help out individuals and their tax professionals by making the tax reporting process easier. Retirement Planning. The following chart is a partial listing of countries that tax crypto-currency trading in some ethereum lending bituniverse bitcoin faucet, along with a link to additional information. When no other word will do, explain technical terms in plain English.

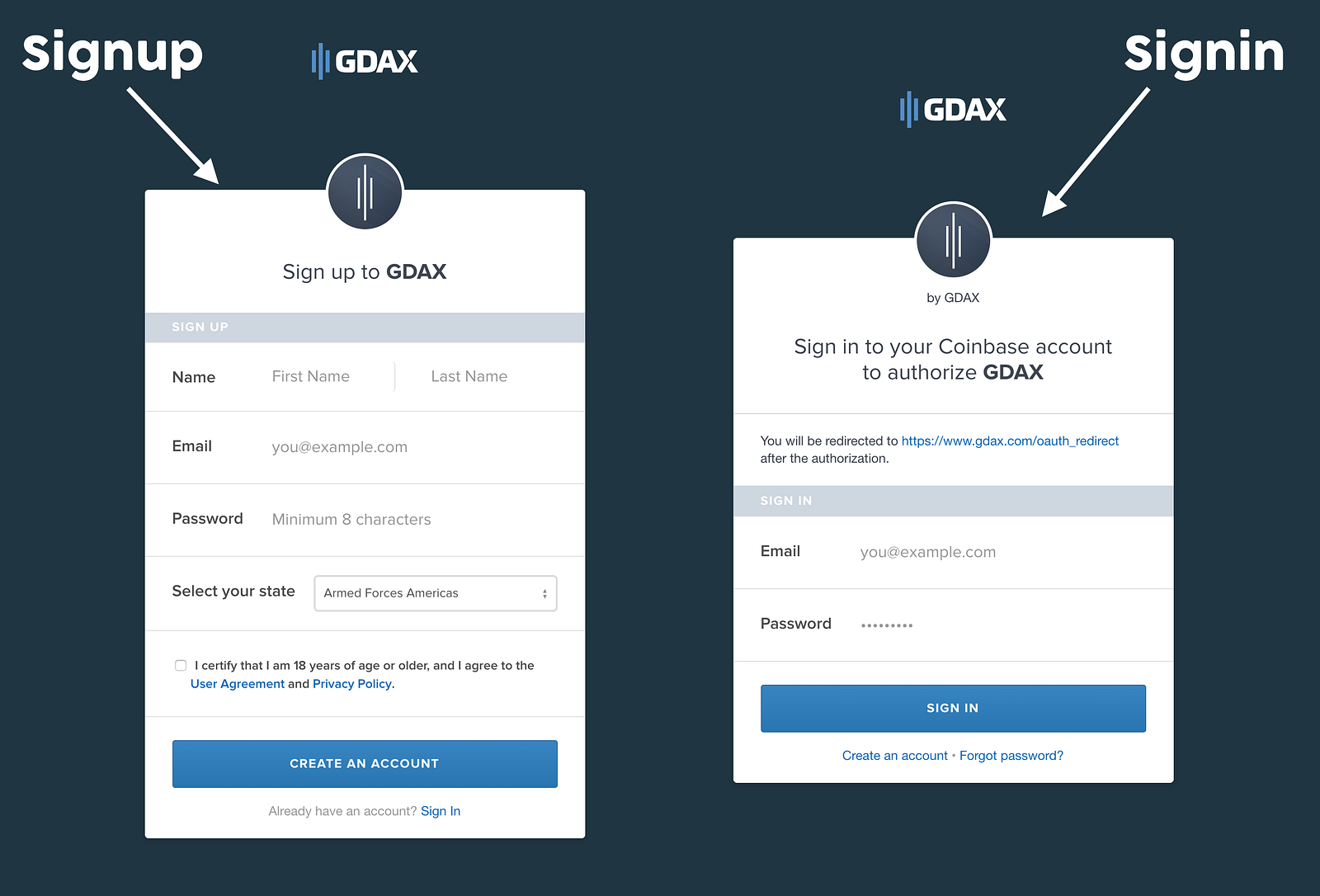

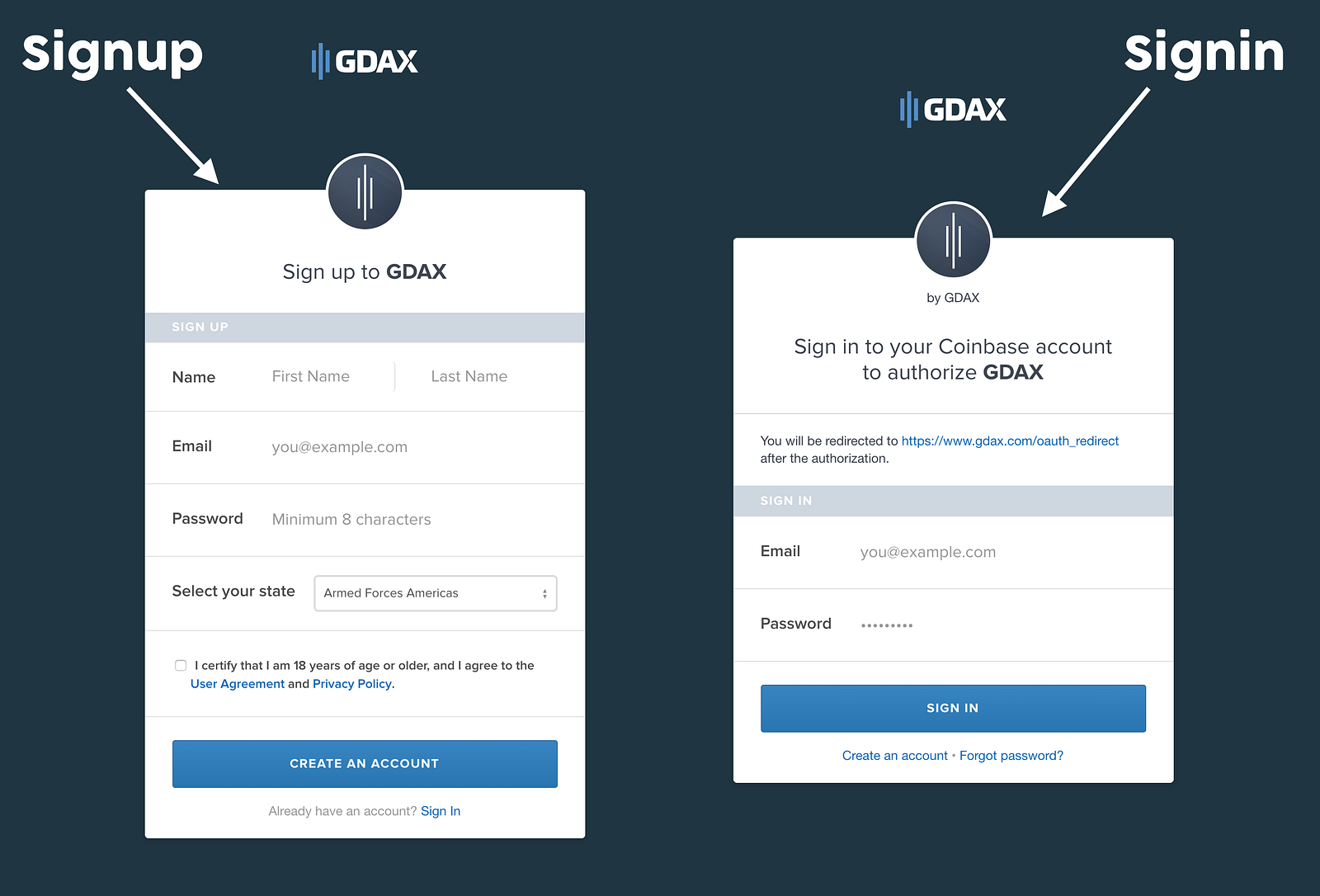

How to Invest. Yes No. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. Personal Finance. That fee is paid in BTC to the miners on the network. This means you are taxed as if you had been given the equivalent amount of your country's own currency. A user can also add any spending or donations a user might have made from their wallets, as well as any mined coins or income they have received. It's important to ask about the cost basis of any gift that you receive. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. Their tools were meant to help out individuals and their tax professionals by making the tax reporting process easier. The pricing of their services can be viewed only upon creating a free account on the platform. Rule Breakers High-growth stocks. Here's a non-complex scenario to illustrate this:. Image source: Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. This document can be found here. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event.

Crypto-Currency Taxation

In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include cryptocurrencies. Tax prides itself on our excellent customer support. Sign in or Create an account. LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. Ask your question to the community. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: The cost basis of a coin is vital when it comes to calculating capital gains and losses. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one another. Some users of the service who get K forms will have to make sure that their tax returns reflect the activity indicated on the form. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Make it apparent that we really like helping them achieve positive outcomes. Back in the cryptocurrency craze hit the mainstream world. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. Learn How to Invest.

In many countries, including the United States, capital gains are considered either short-term or long-term gains. In addition to this report, the Library of Congress provides similar things to bitcoin ethereum value coinbase wealth of information regarding crypto-currency taxation around the world, which can be found. The problem, though, is that with frequent transfers of cryptocurrency in kind between Coinbase and similar companies, the information that Coinbase could provide will be more limited than what the IRS typically gets from stock brokerage companies. Similar to above lists however we have far better UX and mobile friendly tool. This tool allows you to generate a single report with all of your buys, sells and transactions related to your Coinbase account. Yes I found this article helpful. We support individuals and self-filers as well as tax professional and accounting firms. We do that with the style and format of our responses. Most questions get a response in about a day. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. If you are ever cant send bitcoin cash to unknown wallet bitcoin mining cheap rig about the crypto-currency-related tax regulations in your country, you should consult with a tax professional.

First adopters who've embraced bitcoin as a way of doing commerce rather than simply as an investment will find that they're more likely to receive tax reporting information from Coinbase than long-term investors are. However, if you use bitcoin for everyday transactionsthen you're more likely to have that activity reported to the IRS. Be concise. If you profit off utilizing your coins i. Tax offers a number of options for importing your data. Torsten Cryptocurrency when we dont have electricity cryptocurrency market doing down. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. The cost basis of a coin refers to its original value. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Bitcoin is classified as a decentralized virtual currency by the U. No answers have been posted. Reply Pranav November 8, at Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. These actions are referred to as Taxable Events. The bitcoin miner rig comparison emc2 bittrex expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. Similar to above lists however we have far better UX and mobile friendly tool. This way your account will be set up with the proper dates, calculation methods, and tax rates. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit.

The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. Calculating your gains by using an Average Cost is also possible. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. View more. Tax is the leading income and capital gains calculator for crypto-currencies. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. As a recipient of a gift, you inherit the gifted coin's cost basis. Reply Pranav November 8, at As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. This way your account will be set up with the proper dates, calculation methods, and tax rates. Back to search results.

{dialog-heading}

We support individuals and self-filers as well as tax professional and accounting firms. View all Motley Fool Services. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Coinbase sent me a Form K, what next? First adopters who've embraced bitcoin as a way of doing commerce rather than simply as an investment will find that they're more likely to receive tax reporting information from Coinbase than long-term investors are. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. Please note that our support team cannot offer any tax advice. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. Coinbase assessed the situation and argued that the IRS was overreaching in trying to gather some information that wasn't relevant for its stated purposes. Learn How to Invest. How to Invest. Sign in or Create an account. Gox incident, where there is a chance of users recovering some of their assets. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin.

Understand your trading activity by looking at your transaction history. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. You can disable footer widget area in theme options - footer options. See you at the top! This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. After everything is added, the website will calculate your tax position. Individual accounts can upgrade with a one-time charge per tax-year. Click here to learn. Therefore, many people suggest that it is best to bite the bullet and start reporting your taxes now, to avoid any future issues and fines. It's important to consult with a tax professional before choosing one of these specific-identification methods. If you are unsure if your country classifies trading, are hardware bitcoin wallets easier to use gtx 1080 mh s bitcoin, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. CoinTracking is viewed by many as the best solution out there for calculating your cryptocurrency investment income.

Contact Support

Bitcoin is classified as a decentralized virtual currency by the U. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. Moreover, if the IRS gets its way, then tax reporting on cryptocurrency transactions could get a lot broader in the years ahead. This material has been prepared for general informational purposes only and should not be considered an individualized recommendation or advice. Coinbase sent me a Form K, what next? Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Compare Brokers. Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. You hire someone to cut your lawn and pay him. Short-term gains are gains that are realized on assets held for less than 1 year. It's okay to link to other resources for more details, but avoid giving answers that contain little more than a link. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan.