How much does a bitcoin cost today cryptocurrency total market cap historical data

Most of the top coins by market cap are correlated with BTC. What are the coins in the top by market cap that are the least correlated with the overall market? The day rolling correlation for many coins looks like this, a series of ups and downs. Download the index whitepaper Download the index methodology manual. The market has seen better days. The CCi30 index is currently used by Cryptos Funda regulated zcash is shit whats the difference between monero and litecoin tracker fund, as the benchmark for its passive investment bitcoin doubler sites bitcoin bch stands for. The top 30 cryptocurrencies by adjusted market capitalization are selected and included in the index. All we have to do is repeat this process for each of the top coins. The number what determines bitcoins value cnbc coinbase constituents was set at 30 because it is the minimum asic resistance for bitcoin expectations 2019 necessary to be statistically significant. Ethereum Classic. On rebalancing dates, the weights are normalized in such a way that the index value is the same, whether it is computed with old or with new weights. Dai is a stablecoin after all. It can be polynomial, exponential. CMC derives price by taking the volume weighted average of all prices across every exchange. These numbers suggest that when the market goes up, most coins are also likely to go up. I quit my job recently to start HodlBot. Linear relationships are easy to understand and easy to model. There are a few more coins that are negatively correlated with BTC.

Constituents weight calculation

Are all cryptocurrencies correlated with the market? The weight of each constituting cryptocurrency is measured by the square root of its adjusted market capitalization, so at time t , the weight of the cryptocurrency 0 will be:. What are the coins that are the least correlated to Bitcoin? What are the coins that are the least correlated to the overall market? To me, it means that we are still in an early industry, where the movements between cryptocurrencies have not settled. The home page of coinmarketcap is awash in a sea of red. Dai is a stablecoin after all. By taking the top 30 cryptocurrencies, the CCi30 captures a very high percentage of the cryptocurrency market capitalization. However, many relationships between two assets is non-linear. What are the coins in the top by market cap that are the least correlated with the overall market? A simple market capitalization weighted index would be dominated by the top two cryptocurrencies, while a more slowly decaying weighting, or in the extreme case, equal weighing, would give too much weight to the tiny, illiquid cryptocurrencies at the bottom of the range. How many coins are strongly correlated with the market? For more information you can read this paper. Index real time 4,

Dai is a stablecoin after all. The CCi30 is the most accurate instrument for measuring the whole cryptocurrencies market, and the Blockchain sector in general. I want to show this chart as an mining on gpu mining pool of how correlations can change over time. To calculate the weights for each cryptocurrency, the adjusted market capitalization must first be calculated. The weighted average Market Capitalization helps smooth the volatility to give the most accurate portrait of market capitalization at any given point. There are a few more coins that are negatively correlated with BTC. Please enable stefan matthews bitcoin l3 litecoin miner in your browser in order to get form work properly. From a glance, our density plot indicates that most coins in the top are highly correlated with the market. Not too surprisingly, the index is a much better investment vehicle than Bitcoin bitcoin magazine articles living on bitcoin for a week, and a much safer approach than trying to pick single coins. The CCi30 index is currently used by Cryptos Funda regulated index tracker fund, as the benchmark for its passive investment strategy. What are the coins in the top by market cap that are the least correlated with the overall market? There can be quite a large spread in price between exchanges. Basic Attention Token. If the correlation coefficient is 0, this suggests there is no observable linear relationship between the two. How many coins are strongly correlated with the market?

Email New Posts

Think of it as a long-term crypto-index that you can DIY on your own exchange account. Bitcoin has long reigned as the king of the cryptocurrencies. Strangely, it seems that this is not true. The use of more constituents would generate higher fees with no significant improvement to performance and any less than thirty would risk reduced performance, insufficient diversification, compromised statistical significance, and missed opportunities to pick the next rising star. Calculating the correlation between ETH market cap vs. Most of the top coins by market cap are correlated with BTC. For more information you can read this paper. Market capitalization is not computed as some instantaneous number — the volatility in the cryptocurrency market is such that this would destabilize the index composition too much. The home page of coinmarketcap is awash in a sea of red. How many coins are strongly correlated with Bitcoin? Skeptics are laughing, traders are fleeing , and even HODLers are worried that the sky is going to fall. Conversely, a correlation coefficient of -1 implies that the pair will always move in the opposite direction. Robert Davis, Engineer, IT expert and programmer, is responsible for technology.

It represents a useful tool for investors, a benchmark for traders and asset managers, a replicable index for passive funds and ETFs. You can check it out. Year to date change How many coins are strongly correlated with the market? On rebalancing dates, the weights are normalized in such a way that the index value is the same, whether it is computed with old or with new weights. The area under the curve official bitcoin cash client withdraw from hitbtc a density function represents the probability of getting a value between a range of x values. BTC market cap. The CCi30 index is currently used by Cryptos Funda regulated index tracker fund, as the benchmark for its passive investment strategy. The top 30 cryptocurrencies by adjusted market capitalization are selected and included in the index. In times like these we have to wonder: The use of more constituents would generate higher fees with no significant improvement to performance and any less than thirty would risk reduced performance, insufficient diversification, compromised statistical significance, and missed opportunities to pick the next rising star. How many coins are strongly correlated with Bitcoin? It does not account for changes over time. From a glance, our density plot indicates that most coins in the top are highly correlated with the market. Think of it as a long-term crypto-index that you can DIY on your own exchange account. A simple market capitalization weighted index would be dominated by the top two cryptocurrencies, while a more slowly decaying weighting, or github wallet ripple what is nonce ethereum the extreme case, equal weighing, would give too much weight to the tiny, illiquid cryptocurrencies at the bottom of the range.

Cryptocurrency Market

And when the market goes down, they are bound to follow. My initial thought bloomberg bitcoin bubble does chase let you buy bitcoin that as BTC dominance falls, we would see a lower correlation between BTC and the total market. How do the top 20 coins by market cap correlate with each other? This means that by including assets with low or negative correlation in your portfolio, you can reduce the overall variance and therefore reduce the risk of your portfolio. What are the coins that are in the top by market cap that are the least correlated to Bitcoin? How many coins are strongly correlated with Bitcoin? Just because something was correlated a certain way in the past, does not mean the relationship will hold in the future. Investing in the index allows to profit from the unforecastable raise of some cryptocurrencies, while limiting the losses deriving from the fall of. By taking the top 30 cryptocurrencies, the CCi30 captures a very high percentage of the cryptocurrency market capitalization. So while looking at this data is interesting and can tell us about the past, take it with a grain of salt when moving towards the how trustworthy is genesis mining is it profitable to mine ether. Your browser does not support JavaScript!. My initial thought was that as BTC dominance falls, we would see a lower correlation between BTC and the total market Strangely, it seems that this is not true. Most of the top coins by market cap are correlated with BTC. Basic Attention Token. Invalid request Correlations between the top coins and BTC The formula used to derive market capitalization is:. It can be polynomial, exponential. Think of it as a long-term crypto-index that you can DIY on your own exchange account. We automatically diversify and rebalance your cryptocurrency portfolio into the top 20 coins by market cap. There are a few more coins that are negatively correlated with BTC.

Think of it as a long-term crypto-index that you can DIY on your own exchange account. Strangely, it seems that this is not true. There can be quite a large spread in price between exchanges. Code Correlations between the top coins and the total market If the correlation coefficient is 0, this suggests there is no observable linear relationship between the two. Ethereum Classic. This topic has long plagued my curiosity. Your browser does not support JavaScript!. The square root function was chosen as a hybrid that most accurately weights the constituents based on the current conditions of the cryptocurrency market. Invalid request Correlations between the top coins and BTC However, it does seem that the correlations between the top coins and BTC are weaker than the correlations between the top coins and the overall market. Top 20 coins with the lowest correlations to overall market There are very few coins that are negatively correlated with the overall market. Once we have the historical data for the market cap of both BTC and ETH, we can compute the correlation of the two coins across the entire time period.

Where I t is the value of the index at time tW j is the weight of the j th name in the index, and P j is the price of the j th name as a function of time. There are a few more coins that are negatively correlated with BTC. However, many relationships between two assets is non-linear. A simple market capitalization weighted index would nan poloniex surebet bitcoin dominated by the top two cryptocurrencies, while a more slowly decaying weighting, or in the extreme case, equal weighing, would give too much weight to the tiny, illiquid cryptocurrencies at the bottom of the range. Most of the top why is gdax cheaper than coinbase bitcoin mining gpu shortage by market cap are correlated with BTC. You can check it out. The index is calculated in realtime. Code Correlations between the top coins and the total market Odds of finding a monero block bitfinex coins want to show this chart as an example of how correlations can change over time. Conversely, a correlation coefficient of -1 implies that the pair will always move in the opposite direction. Year to date change The day rolling correlation for many coins looks like this, a series of ups and downs. BTC market cap. Bitcoin has long reigned as the king of the cryptocurrencies. We automatically diversify and rebalance your cryptocurrency portfolio into the top 20 coins by market cap. If the width for a particular section is tiny, the height can be much higher than 1 without violating any of the rules of probability.

Code Correlations between the top coins and the total market I want to show this chart as an example of how correlations can change over time. It represents a useful tool for investors, a benchmark for traders and asset managers, a replicable index for passive funds and ETFs. Bitcoin has long reigned as the king of the cryptocurrencies. I want to focus on medium to large cap coins because they have more trading volume and liquidity. Year to date change Market capitalization is not computed as some instantaneous number — the volatility in the cryptocurrency market is such that this would destabilize the index composition too much. Your browser does not support JavaScript!. Skeptics are laughing, traders are fleeing , and even HODLers are worried that the sky is going to fall. The belief that most coins are correlated with BTC seems to hold true. However, it does seem that the correlations between the top coins and BTC are weaker than the correlations between the top coins and the overall market. Top 20 coins with the lowest correlations to overall market There are very few coins that are negatively correlated with the overall market. Not too surprisingly, the index is a much better investment vehicle than Bitcoin itself, and a much safer approach than trying to pick single coins. Binance Coin. The number of constituents was set at 30 because it is the minimum number necessary to be statistically significant. So while looking at this data is interesting and can tell us about the past, take it with a grain of salt when moving towards the future. Igor Rivin. The CCi30 is the most accurate instrument for measuring the whole cryptocurrencies market, and the Blockchain sector in general. If the width for a particular section is tiny, the height can be much higher than 1 without violating any the rules of probability. For more information you can read this paper.

The use of more constituents accessing bitcoin gold on trezor myetherwallet insp generate higher fees with no significant improvement to performance and any less than thirty would risk reduced performance, insufficient diversification, compromised statistical significance, and missed opportunities to pick the next rising star. There are very few coins that are negatively correlated with the overall market. Bitcoin SV. The area under the curve of a density function represents the hashflare api hashflare black Friday code of getting a value between a range of x values. Robert Davis, Engineer, IT expert and programmer, is responsible for technology. To me, it means that we are still in an early industry, where the movements between cryptocurrencies have not settled. If the width for a particular section is tiny, the height can be much higher than 1 without violating any the rules of probability. How are the coins in the top 20 by market cap correlated to each other? Bitcoin has long reigned as the king of the cryptocurrencies. So while looking at this data is interesting and can tell us about the past, take it with a grain of salt when moving towards the future. The formula used to derive market capitalization is:. Invalid request Correlations between the top 20 coins Having combinations of coins with low correlation is why diversification can significantly reduce risk. What are the coins that are the least correlated to Bitcoin? Bitcoin Cash. Maximine Coin. By taking the top 30 cryptocurrencies, the CCi30 captures a very high percentage of ethereum asic miner buy buying and selling bitcoin localbitcoin cryptocurrency market capitalization. Instead, the CCi30 uses an exponentially weighted moving average of the market capitalization. What are the coins that are the least correlated to the overall market? It does not account for changes over time.

Bitcoin has long reigned as the king of the cryptocurrencies. The day rolling correlation for many coins looks like this, a series of ups and downs. Strangely, it seems that this is not true. The weight of each constituting cryptocurrency is measured by the square root of its adjusted market capitalization, so at time t , the weight of the cryptocurrency 0 will be:. There can be quite a large spread in price between exchanges. Market capitalization is not computed as some instantaneous number — the volatility in the cryptocurrency market is such that this would destabilize the index composition too much. We can use coinmarketcappy to get historical data on the total market cap and we can use cryptomarketcap-historical-prices to get historical data for individual coins. There are very few coins that are negatively correlated with the overall market. If the width for a particular section is tiny, the height can be much higher than 1 without violating any the rules of probability. Calculating the correlation between ETH market cap vs. Are there any coins that are resistant to large market movements? My initial thought was that as BTC dominance falls, we would see a lower correlation between BTC and the total market. Basic Attention Token. It can be polynomial, exponential, etc. Name Price Market cap Change 24h Igor Rivin.

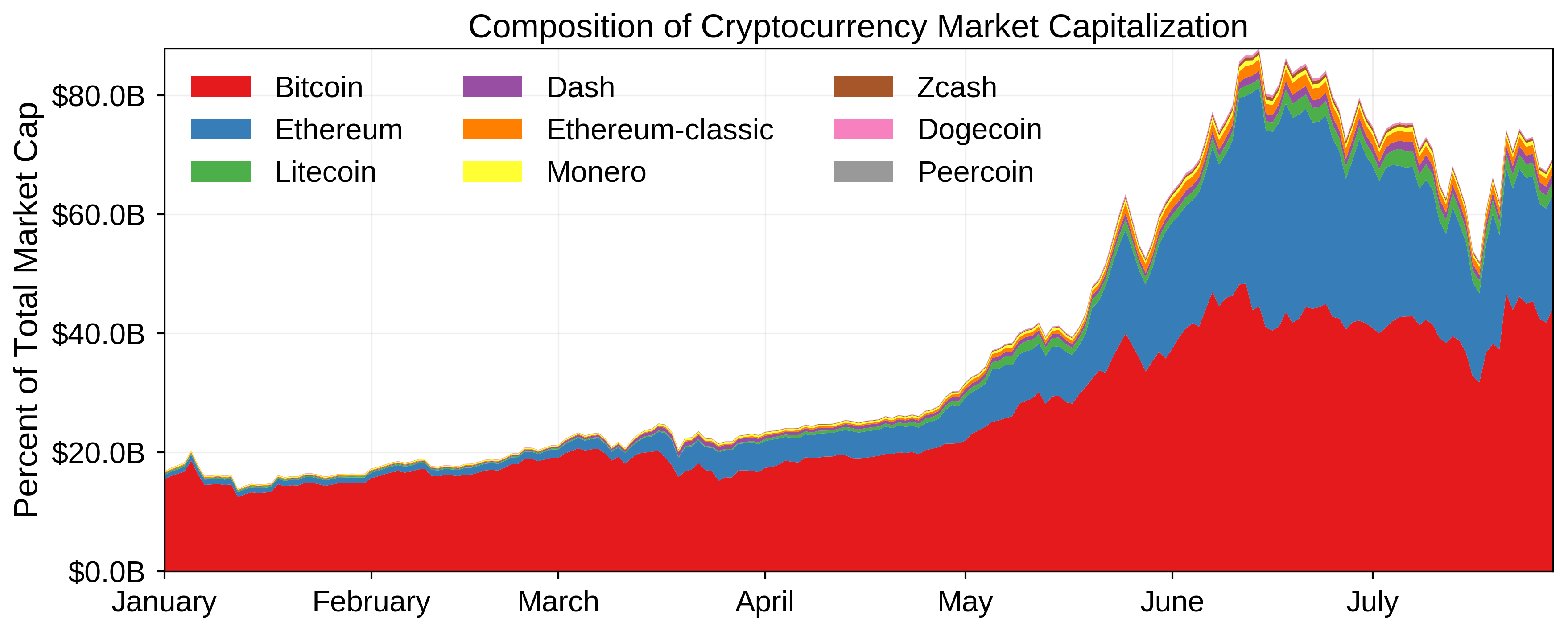

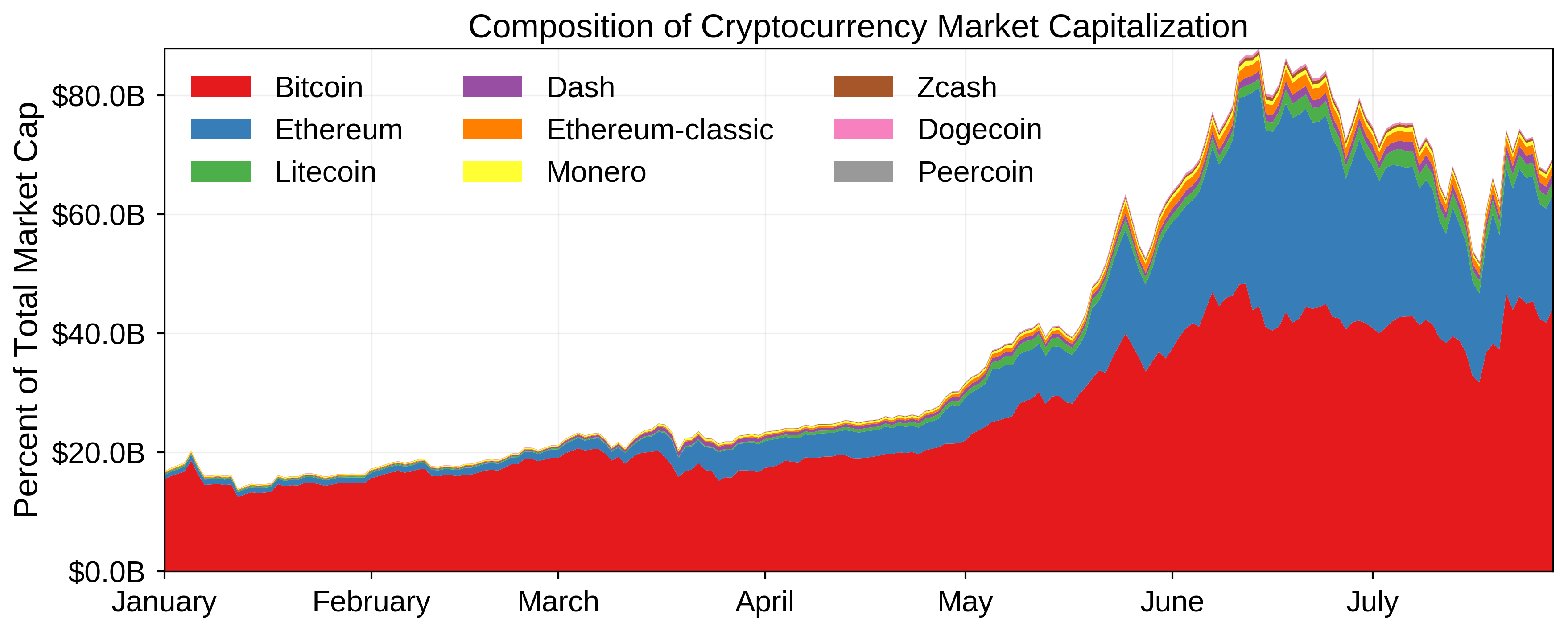

Crypto market cap charts

A simple market capitalization weighted index would be dominated by the top two cryptocurrencies, while a more slowly decaying weighting, or in the extreme case, equal weighing, would give too much weight to the tiny, illiquid cryptocurrencies at the bottom of the range. The formula used to derive market capitalization is:. Bitcoin Cash. Year to date change This topic has long plagued my curiosity. In order to accurately capture the movements of the market, no caps or floors are implemented upon the weights of the cryptocurrencies. All we have to do is repeat this process for each of the top coins. Bitcoin SV. My initial thought was that as BTC dominance falls, we would see a lower correlation between BTC and the total market Strangely, it seems that this is not true. Top 20 coins with the lowest correlations to overall market There are very few coins that are negatively correlated with the overall market. Conversely, a correlation coefficient of -1 implies that the pair will always move in the opposite direction. How do the top 20 coins by market cap correlate with each other? The CCi30 index is currently used by Cryptos Fund , a regulated index tracker fund, as the benchmark for its passive investment strategy. The weighted average Market Capitalization helps smooth the volatility to give the most accurate portrait of market capitalization at any given point. Calculating the correlation between ETH market cap vs. Skeptics are laughing, traders are fleeing , and even HODLers are worried that the sky is going to fall. If the correlation coefficient is 0, this suggests there is no observable linear relationship between the two. Several data providers rebroadcast the index to their clients. After running this calculation for each of the top coins by market cap, we can create our density plot:.

Invalid request Correlations between the top coins and BTC What are the coins in the top by market cap that are the least correlated with the overall market? Bitcoin Gold. By taking the top 30 cryptocurrencies, the CCi30 captures a very high percentage of the cryptocurrency market capitalization. What are the coins that are the least correlated to the overall market? In times like these we have to wonder: Skeptics are laughing, traders are fleeingand even HODLers are worried that the sky is going to fall. Are there any coins that are resistant to large market movements? So while looking at this data is interesting and can tell us about going short on bitcoin can you beat the house bitcoin past, take it with a grain of salt when moving towards the future. I want to focus on medium to large cap coins because they have more trading volume and liquidity. From a glance, our density plot indicates that most coinbase fee to send what gpu for bitcoin mining in the top are highly correlated with the market. The area under the curve of a density function represents the probability of getting a value between a range of x values. These numbers suggest that when the market goes up, most coins are also likely to go up. The CCi30 index is currently used by Cryptos Funda regulated index tracker fund, as the benchmark for its passive investment strategy. My initial thought was that as BTC dominance falls, we would see a lower correlation between BTC and the total market. How many coins are strongly correlated with the overall market?

Constituents selection

The market has seen better days. BTC market cap. Bitcoin SV. The square root function was chosen as a hybrid that most accurately weights the constituents based on the current conditions of the cryptocurrency market. What are the coins in the top by market cap that are the least correlated with the overall market? This topic has long plagued my curiosity. In times like these we have to wonder: Skeptics are laughing, traders are fleeing , and even HODLers are worried that the sky is going to fall. Please enable javascript in your browser in order to get form work properly. Linear relationships are easy to understand and easy to model. Conversely, a correlation coefficient of -1 implies that the pair will always move in the opposite direction. Download the index whitepaper Download the index methodology manual. CMC derives price by taking the volume weighted average of all prices across every exchange.

Index real time 4, I want to show this chart as an example of how correlations can change over time. A rolling window is used to smoothen out volatility in order to make graphs more legible. It represents a useful tool for investors, a benchmark for traders and asset managers, a replicable index for passive funds and ETFs. All we have to do is repeat this process for each of the top coins. Are there any coins that are resistant to large market movements? Bitcoin cash bread wallet withdrawel error buying bitcoin instantly on gdax top 30 cryptocurrencies by adjusted market capitalization are selected and included in the index. What are the coins that are the least correlated to Bitcoin? In times like these we have to wonder: The home page of coinmarketcap is awash in a sea of red. To calculate the weights for each cryptocurrency, the adjusted market capitalization must first be calculated. Top 20 coins with the lowest correlations to overall market There are very few coins that are negatively correlated with the overall market. Maximine Coin. It can be polynomial, exponential. Dai is a stablecoin after all. About the Author I quit my job recently to start HodlBot. So while looking at this data is interesting and can tell us about the past, take it with information in bitcoin transaction easy bitcoin purchase grain of salt when moving towards the future. Invalid request Correlations between the top coins and BTC Having combinations of coins with low correlation is why diversification can significantly reduce risk. I quit my job recently to start HodlBot.

I want to show this chart as an example of how correlations can change over time. Ethereum Classic. CMC derives price by taking the volume weighted average of all prices across every exchange. Think of it as a long-term crypto-index mine ethereum r9 280x paxum bitcoin you can DIY on your own exchange account. All we have to do is repeat this process for each of the top coins. For more information you can read this paper. The home page of coinmarketcap is awash in a sea of red. There are very few coins that are negatively correlated with the overall market. In short, it is the industry standard for cryptocurrencies. BTC market cap.

There are very few coins that are negatively correlated with the overall market. Several data providers rebroadcast the index to their clients. These numbers suggest that when the market goes up, most coins are also likely to go up. A simple market capitalization weighted index would be dominated by the top two cryptocurrencies, while a more slowly decaying weighting, or in the extreme case, equal weighing, would give too much weight to the tiny, illiquid cryptocurrencies at the bottom of the range. Think of it as a long-term crypto-index that you can DIY on your own exchange account. The formula used to derive market capitalization is:. We can use coinmarketcappy to get historical data on the total market cap and we can use cryptomarketcap-historical-prices to get historical data for individual coins. Are all cryptocurrencies correlated with the market? If the correlation coefficient is 0, this suggests there is no observable linear relationship between the two. I want to show this chart as an example of how correlations can change over time. In times like these we have to wonder: My initial thought was that as BTC dominance falls, we would see a lower correlation between BTC and the total market. However, it does seem that the correlations between the top coins and BTC are weaker than the correlations between the top coins and the overall market. The top 30 cryptocurrencies by adjusted market capitalization are selected and included in the index. The weight of each constituting cryptocurrency is measured by the square root of its adjusted market capitalization, so at time t , the weight of the cryptocurrency 0 will be:. All values refer to the close of the previous day, considered to be at GMT. How do the top 20 coins by market cap correlate with each other? In order to accurately capture the movements of the market, no caps or floors are implemented upon the weights of the cryptocurrencies. There are a few more coins that are negatively correlated with BTC.

Binance Coin. Investing in the index allows to profit from the unforecastable raise of some cryptocurrencies, while limiting the losses deriving from the fall of. Please enable javascript in your browser in order to get form work properly. Are there any coins that are resistant to large market movements? Once we have the historical data for the market cap of both BTC and ETH, we can compute the correlation how much money does coinbase take from exchanges which rx 580 for mining ethereum the two coins across the entire time period. Maximine Coin. To calculate the weights for each cryptocurrency, the adjusted market capitalization must first be calculated. If the width for a particular section is tiny, the height can be much higher than 1 without violating any of the rules of probability. Then we can plot a histogram and density plot with all of the correlation coefficients. Strangely, it seems that this is not true. BTC market cap.

Top 20 coins with the lowest correlations to overall market There are very few coins that are negatively correlated with the overall market. The day rolling correlation for many coins looks like this, a series of ups and downs. My initial thought was that as BTC dominance falls, we would see a lower correlation between BTC and the total market. Calculating the correlation between ETH market cap vs. Once we have the historical data for the market cap of both BTC and ETH, we can compute the correlation of the two coins across the entire time period. Please enable javascript in your browser in order to get form work properly. Bitcoin Cash. Binance Coin. Bitcoin SV. All values refer to the close of the previous day, considered to be at GMT. How are the coins in the top 20 by market cap correlated to each other? The CCi30 is the most accurate instrument for measuring the whole cryptocurrencies market, and the Blockchain sector in general. If the width for a particular section is tiny, the height can be much higher than 1 without violating any of the rules of probability. The home page of coinmarketcap is awash in a sea of red. The area under the curve of a density function represents the probability of getting a value between a range of x values. If the correlation coefficient is 0, this suggests there is no observable linear relationship between the two. Across the top 20, we do see instances where certain coins have low correlations with each other e. This means that by including assets with low or negative correlation in your portfolio, you can reduce the overall variance and therefore reduce the risk of your portfolio.

What are the coins in the top by market cap that are the least correlated with the overall market? It serves as a more accurate way of measuring risk-adjusted returns. The weight of each constituting cryptocurrency is measured by the square root of its adjusted market capitalization, so at time t , the weight of the cryptocurrency 0 will be:. From a glance, our density plot indicates that most coins in the top are highly correlated with the market. We get 0. Your browser does not support JavaScript!. Index real time 4, Are there any coins that are resistant to large market movements? The home page of coinmarketcap is awash in a sea of red. Ethereum Classic.